Introduction

This article will give you a thorough introduction to what Bitcoin is, how it was created, how it works, what gives it value, and how it differs from regular national currencies, especially in the context of Keynesian and Austrian economic theory. In the end there is also a brief account of what the technology behind Bitcoin can be used for in addition to the application as money.

Nomenclature

The convention is to use uppercase B (Bitcoin) when talking about the payment network, software and community, and to use lowercase b (bitcoin) when talking about units of the currency. Unlike other currencies, Bitcoin is both a payment network and a currency simultaneously. This makes it fundamentally different from regular currencies such as the US dollar where the currency and payment networks are separate parts.

An analogy

To understand the significance of this it can be helpful to make an analogy. Imagine Bitcoin as a car that is simultaneously the road it is traveling on. This car can travel anywhere in the world and there are no border guards or third parties who can stop it or charge an extra fee for its travel. An electronic US dollar in this car analogy would need permission to travel on roads built and owned by third parties who determines the rules and may charge fees along the way, or simply stop unwanted cars from reaching there destination for whatever reason.

The invention of Bitcoin

Bitcoin is the world’s first decentralized electronic currency. In November 2008, an article was published with the title “Bitcoin: A Peer-to-Peer Electronic Cash System” by the pseudonym “Satoshi Nakamoto” to an email list for cryptography on metzdowd.com. The article describes how a peer-to-peer electronic cash system can be created that makes it possible to send money directly between two parties without intermediaries.

The anonymous creator (or creators) of Bitcoin was the first to find a solution to how double-spending can be avoided in a decentralized electronic payment network. This problem had until then made it impossible to create an electronic currency without a central trusted third party to verify that the digital coins are not copied and used multiple times.

A decentralized solution to double-spending

The solution consists of all transactions being publicly published to all participants (nodes) in the network, and for all participants to agree on a common history of every transaction, which is locked cryptographically in a chronological chain of transaction blocks (a blockchain) through a process called proof-of-work. Proof-of-work is used to ensure that the longest blockchain was created by the majority of the computing power in the network, and it is always the longest blockchain (created with the most work) that is considered as the correct transaction history. Bitcoin uses proof-of-work to solve the computer science problem “Byzantine Generals’ Problem” which concerns how different participants in an insecure communication network can coordinate with each other in a safe manner.

Incentives for verifying transactions, i.e. to lock in transactions in the blockchain by spending computational power, is given by rewarding those who manage to compute a cryptographic solution to a transaction block with a predetermined number of newly created bitcoins, and additionally they receive all the transaction fees that the transactions in the block contains. This process of creating new bitcoins by performing calculations that verifies transactions is called mining, it has similarities with the way new gold is put in circulation. The difficulty of finding a cryptographic solution to a block of transactions is automatically adjusted so that it takes on average 10 minutes for all the computing power connected to the network to randomly find a solution.

How bitcoins come into existence

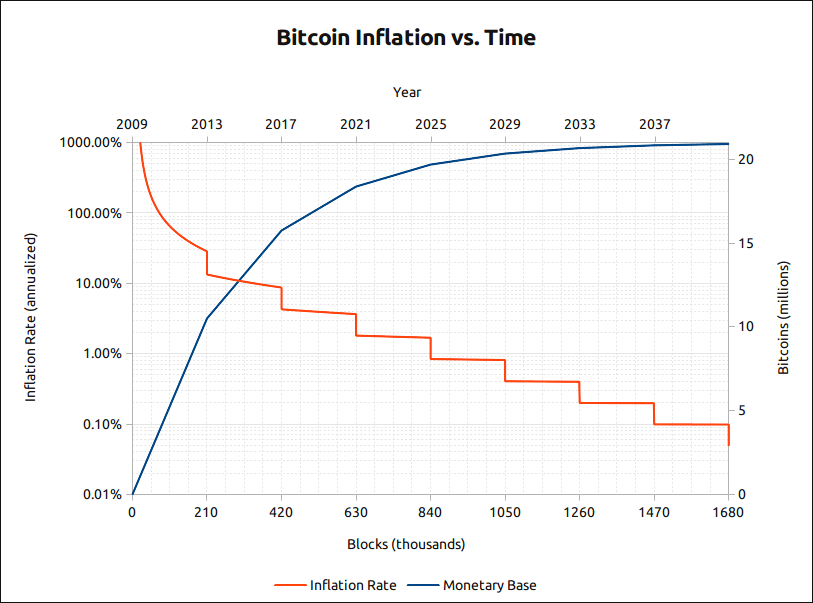

All bitcoins that exists have been created as reward for solving blocks in the blockchain. From the beginning the reward was 50 new bitcoins per block, but every four years the reward is halved. The rate of increase (inflation) of bitcoin is thus high in the beginning but halves every four years, and the total number of bitcoins will eventually level off at 21 million. Each bitcoin is divisible into 100 million pieces, where the smallest unit 0.00000001 bitcoin is called one Satoshi.

Bitcoin transaction security

The registered transactions in the blockchain is secure against manipulation as long as a cooperating group of malicious actors do not control more than 50% of the computational power of the entire network. To modify an existing block in the blockchain a malicious actor would have to redo the proof-of-work needed for that specific block and all subsequent blocks, and catch up to become the longest chain. To do this requires a large percentage of the total computing power of the network and the probability of being able to modify a previous block falls exponentially with the number of new blocks added after that block.

If a malicious actor manages to control more computing power than all others together, he can choose between two possibilities. The first option is to steal back his own payments (double spend) and have the power to determine which transactions he will allow others to make. The other option is to follow the rules and look forward to being awarded more bitcoins than everyone else combined in the future rather than undermining the credibility of the entire network and the basis of his own wealth.

Transparency and anonymity

In Bitcoin all transactions are public in a similar way as in a stock market. Everyone can see which transactions take place, there size and time, but they can be anonymous as long as no personal identities are associated with the individual account addresses used. In practice it is much more difficult to make anonymous transactions with bitcoins than with cash.

The price of bitcoin

The price of Bitcoin is determined solely by supply and demand in what constitutes one of the world’s most free global markets. When Bitcoin was first started in early 2009, bitcoins had no market value. One of the first known transactions that prescribed a value to bitcoin was initiated on the forum bitcointalk.org in May 2010 when the forum member Laszlo from Florida payed 10,000 bitcoins for two pizzas.

The principle of how the price of bitcoins have increased since then is described by Ludwig von Mises’ regression theorem. This Theorem explains how something can go from being subjectively valued to something that obtains a more objective exchange value, such as money.

Features of good money

For something to be considered as money it needs to function as a store of value, a medium of exchange, and a unit of account. To be able to do this as well as possible there are nine characteristics that determine what is good money. These are: limited quantity, durability, portability, divisibility, ease of recognition, ease of storage, fungibility, difficulty to forge, and widespread use.

Keynesian vs Austrian school

The currency bitcoin can be thought of as price deflationary, i.e. the value of the currency will increase over time if bitcoin becomes a generally accepted currency, as the total number of bitcoins will never exceed 21 million. This means that prices of goods and services will fall in terms of bitcoins if the productivity of the economy continues to increase as more goods and services will chase the same amount of bitcoins.

Keynesian economists argue that price deflation is bad for primarily three reasons. First, it provides an incentive to save rather than to consume, and it reduces the incentive to borrow money. Second, the real debt burden of borrowers will increase over time. Third, they argue that nominal wage cuts would be difficult to implement. According to Keynesian economics, it is desirable to push down lending rates and expand the money supply to provide incentives for increased borrowing and increased consumption in order to increase the economic activity to create more jobs.

Austrian economists argue on the contrary that the expansion of the total money supply (inflation) and depression of interest rates to artificially low levels is negative for the economy as a whole, and the main cause of the business cycle. This is because the artificially depressed interest rates do not reflect the time preference of society, i.e. how much people are willing to postpone consumption in the present, in anticipation of a larger reward in the future. The artificially low interest rates means that investments can be made, that in a normal situation would not be profitable, because they are not sufficiently demanded by consumers. The aggregated undesired investments made possible through artificially low interest rates shows up sooner or later through a recession where businesses without sufficient demand for their products goes bankrupt, resulting in high unemployment. In recessions Keynesian economists usually demands stimulus through the creation of even more money, even lower interest rates and more government spending, resulting in a temporary boom in which a new round of undesired investment are made because of artificially low interest rates and a large supply of new money and credit, and so it continues with booms and busts caused by centrally controlled manipulation of interest rates and money supply.

With a currency that increases in value over time as the economy grows people would probably not spend money on unnecessary consumption and be more thoughtful how they spend their money. This does not mean that they will stop consuming. If that were the case no computers or mobile phones would be sold since they are subject to rapid price deflation, constantly getting better and decreasing in price.

In an economy without expansion of the money supply and manipulation of interest rates, the interest rates would be determined by the amount of savings in the economy, reflecting the time preference of society. A currency that increases in value over time provides incentives for saving, which probably would give rise to a large amount of saved money and this would naturally drive down interest rates.

In an economy with price deflation an employer would not need to raise wages to compensate for increasing prices, but in real terms the salary would go up even if it was standing still nominally. If the rest of the economy is much more productive than a individual company, the value of the currency would rise faster than the profit of the individual company. This means that the product or service that the company produces is not demanded by society at the price they are capable of producing it. This is a signal from society that it would be better if they devoted their energy to produce something else that is more in demand. There are also historical examples where wages have fallen over 50% in nominal terms due to contraction of the total money supply in society (real deflation).

The primary reason however why Keynesian economists want to make people terrified of deflation is probably because we live in a debt-based economy. In the economy we live in today about 97% of all circulating money is actually credit, created by commercial banks on people’s bank accounts. This is clearly stated openly in this press release on money creation from Bank of England. This means that if a large proportion of bank customers would withdraw their money at the same time, the banks wouldn’t have coverage for it. This would lead to a chain reaction of banks going bankrupt and a large amount of money represented on people’s bank accounts would disappear from circulation. This would lead to a real deflation where the total amount of money decreases, in contrast to a price deflation where only the price decreases and not the total amount of money.

If bitcoin would become a dominant currency, centrally controlled manipulation of the economy through regulating money supply and interest rates would no longer be possible. In addition, bitcoin is not created through somebodies debt.

Irreversible transactions

An important aspect of Bitcoin is that transactions are irreversible. This reduces transaction costs and the need for personal identification. In traditional payment networks, payments are reversible, which means that banks can not escape handling disputes. This in turn makes transaction costs higher and small transactions disproportionately expensive. Reversible transactions puts merchants in danger of being cheated, and for this reason they will insist on more information about their customers than they would otherwise need to protect themselves.

Because bitcoin transactions can not be reversed it is possible to safely receive payments from anonymous persons and persons you do not trust. This has previously only been possible with physical cash, but over electronic channels, this has not been possible before Bitcoin. You can read more about this in my article: Benefits for merchants to accept bitcoin.

Bitcoin is open source

Bitcoin is open source software. Anyone with sufficient programming skills can read the code, contribute to the code, and if they want to, copy the code and start a new cryptocurrency. There are thousands of different cryptocurrencies created this way but Bitcoin is by far the dominant in terms of market value, developer momentum, venture capital investment, merchant adoption, and many other metrics.

Bitcoin is speech

Bitcoin is a protocol – a precisely specified language that computers use to communicate value with each other over the Internet. In the same way that computers use the SMTP protocol to send email over the Internet, and how computers use the TCP/IP protocol for the communication that establishes the Internet in the first place.

Other uses of Bitcoin and blockchain technology

In this introductory text to Bitcoin, I have omitted applications of the blockchain technology other than the use as a currency. The blockchain in a much broader sense is a technology for recording ownership and trust in a decentralized way. There is much more than currency that can be decentralized using blockchain technology. To quote Andreas Antonopoulos “Saying that Bitcoin is a currency is like saying that the internet is email. Currency is just the first app“.

All services currently provided via a central party, can, and most likely will, be decentralized and provided for lower cost in the future based on blockchain technology, e.g. trading, stocks, bonds, contracts, notary services, insurance, matchmaking, law, dispute resolution, communication, crowdfunding, and much more.

Decentralization means that the power is distributed, and this reduces the possibility for corruption and large scale failures.

Will bitcoin or some other decentralized cryptocurrency become a dominant global currency in the future? Only time will tell…

Pingback: Elliptiska kurvor och Bitcoin / Elliptic curves and Bitcoin - Ankor på vift